Unity Bank’s CEO Reaffirms Dedication to Exceptional Customer Service

Samuel Mobolaji

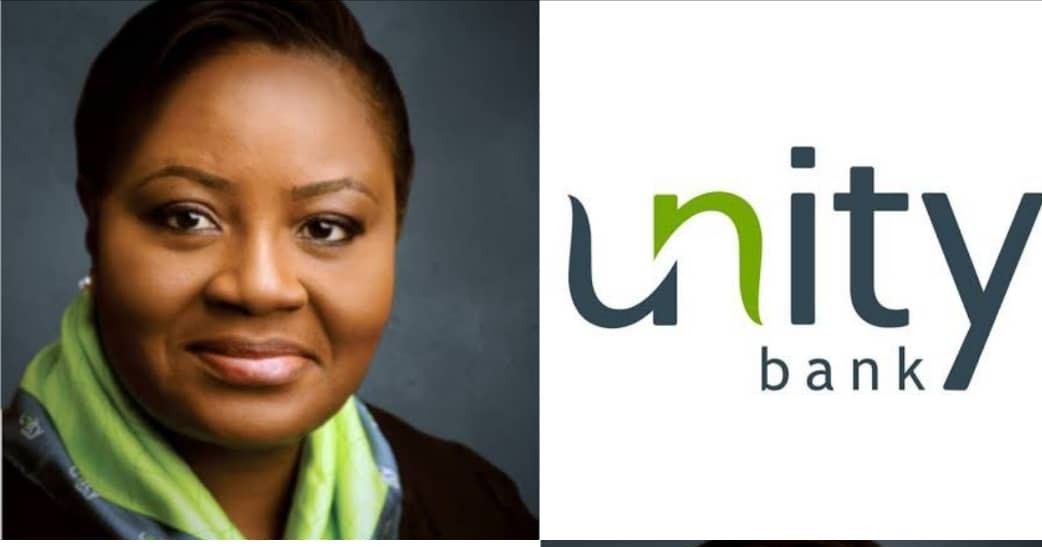

The Managing Director and CEO of Unity Bank Plc, Mrs. Tomi Somefun, has praised the bank’s frontline staff for their commitment to delivering top-tier customer service, fostering a culture of responsiveness and strong partnerships in line with the bank’s Customer Service Charter.

In a message marking Customer Service Week 2024, Mrs. Somefun acknowledged the hard work of the bank’s customer service staff and expressed deep gratitude to clients for their trust and loyalty, which continue to drive the bank’s growth and success.

“This year’s theme, ‘Above and Beyond,’ aligns with our mission at Unity Bank and allows us to reflect on the journey where customers remain the heart of our business,” she stated.

Mrs. Somefun also emphasized the bank’s ongoing investments in innovation and system improvements, promising new tools and strategies to enhance customer experience. “Whether through improved digital platforms or personalized services, we remain committed to making banking with us even better,” she added.

She highlighted the crucial role of frontline staff in building strong customer relationships, noting that their dedication, resilience, and professionalism embody the “Above and Beyond” spirit.

“Every day, our team goes the extra mile, ensuring each customer interaction is handled with care and excellence. Their commitment is why customers continue to choose Unity Bank,” Mrs. Somefun said.

Echoing this sentiment, Chief Customer Service Officer Elfrida Igebu expressed pride in the staff’s efforts during the week, emphasizing how exceeding expectations and personalizing customer experiences have set Unity Bank apart.

The celebration, held from October 7–11, featured activities across Unity Bank’s 200 branches, rewarding outstanding staff and reinforcing the team’s professional bonds.

The bank’s digital strategy, which includes innovations like the multilingual USSD banking *7799# and the UniFi mobile app, continues to enhance customers’ access to services, putting them first in every aspect of their banking experience.