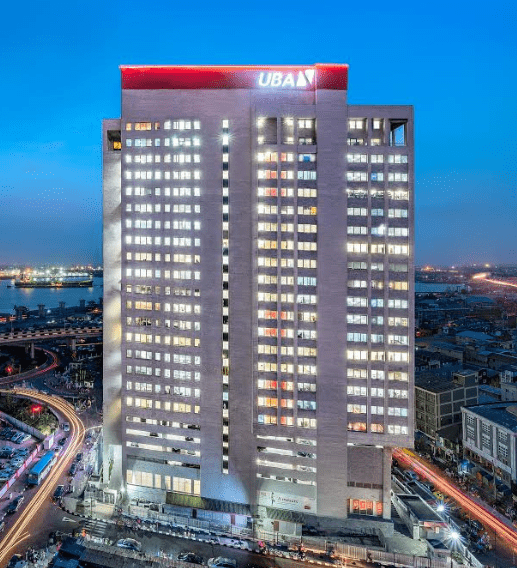

UBA Reports record N767bn Annual Profit Amid Higher Interest Rates

United Bank for Africa (UBA) posted its biggest net profit on record for the financial year 2024 as the interest income of the pan-African lender expanded more than twofold, its audited account issued on Monday showed.

After-tax profit was up by 26.1 per cent at N766.6 billion, compared to N607.7 billion a year earlier.

Shares in UBA had jumped 5 per cent as of 12.47 WAT in Lagos following the announcement the lender will hand shareholders N3 per share in final dividend, bringing its potential total dividend for the year to N5 per unit and total payout to record N171 billion.

Like many other lenders in Nigeria, UBA leveraged the Central Bank of Nigeria’s aggressive monetary policy tightening, which scaled up the benchmark lending rate by 875 basis points last year, to charge more for loans.

Net interest income, a key profitability indicator that measures the difference between what banks charge borrowers and what they pay savers, leapt 116.4 per cent to N1.5 trillion.

The financial institution put aside N217 billion, 50.6 per cent more than it did in 2023, to protect against potential defaults as a cost-of-living crisis in Nigeria strained the finances of borrowers, making them more likely to fall behind on payments.

Fees and commission income increased by 91.7 per cent, helped by a dramatic growth in e-banking income, which encompasses income generated via channels like ATM POS terminals, mobile banking as well as debit and credit cards.

Net trading and foreign exchange gain slid 72.4 per cent to N181.1 billion, taking a blow from a N342.2 billion net fair value loss on derivatives. UBA increased employee benefit expenses by 72.1 per cent during the year, while other operating expenses jumped to N682.9 billion from N372.8 billion.

Read Also: 5 Inmates Of Kogi Jail Break Recaptured

UBA, which has footprints in 20 African countries in addition to the UK, USA and UAE as well as a representative office in France, has over 45 million customers, according to the information on its website.

Pre-tax profit for the period under review climbed to N803.7 billion from N757.7 billion.

The lender reported exchange differences on translation of foreign operations in the sum of N590 billion up from N435.9 billion, helping take its total comprehensive income for the year to N1.5 trillion.

Total assets stood at N30.3 trillion, compared to N20.7 trillion a year earlier.