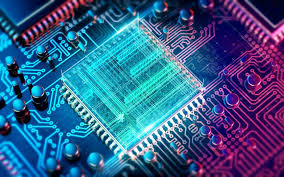

Adoption of Digital Tools to Strengthen Nigeria’s Compliance Culture, Says Expert

Samuel Mobolaji

Stakeholders have emphasised the urgent need for digital innovation to address deep-rooted compliance gaps and foster a culture of accountability across public institutions.

This call to action followed a recent high-level workshop organised by the Senate Committee on Legislative Compliance, which gathered lawmakers, regulators, and leaders from various Ministries, Departments, and Agencies (MDAs) to discuss Nigeria’s ongoing challenges in regulatory adherence and governance.

The two-day event, held in Abuja and themed “Consolidating Strategies for Strengthening Legislative Compliance by MDAs,” featured prominent industry experts from organisations such as the Economic and Financial Crimes Commission (EFCC), the Nigerian Bar Association (NBA), the Ministry of Finance, and key players in Nigeria’s financial sector, including fintech firms.

They advocated for the implementation of digital tools as essential for enhancing transparency and enforcing legislative resolutions.

The Senate president, Godswill Akpabio, represented by Senator Osita Izunaso, emphasised that compliance is fundamental to democratic governance.

He reiterated the Senate’s renewed commitment to effective enforcement and institutional reform, citing constitutional provisions that grant legislative powers for lawmaking aimed at peace, order, and good government.

The workshop also presented a wide array of statistics highlighting the high costs of non-compliance and the underlying causes of these issues, while attempting to propose solutions.

Amidst calls for systemic reforms, general counsel at Moniepoint Inc., Okechukwu Eke delivered a keynote presentation focused on the responsibilities of fintech firms in consumer protection and financial literacy. Eke highlighted Moniepoint’s commitment to fostering a compliance culture that goes beyond superficial adherence to regulations in order to create a genuine impact.

At Moniepoint, we believe that innovation in financial services must go hand in hand with strong consumer protection and legal responsibility, Eke stated. He stressed the unique role of fintech companies, which often serve vulnerable populations with low financial literacy, making robust consumer protection essential.

He noted that misuse or misunderstanding of financial products can lead to significant financial harm, asserting that legal compliance is crucial for building trust in digital financial services.

His presentation outlined key legal responsibilities for fintech firms, including transparency, data privacy, fair marketing, effective grievance handling, and responsible lending.

Other contributions at the workshop advocated for leveraging technology to embed compliance more effectively within organisations.

The workshop concluded with a reinforced commitment from legislative leaders, including Committee Chairman Senator Garba Maidoki and Vice-Chairman Senator Ede Dafinone, to pursue collaborative and innovative solutions to Nigeria’s compliance challenges. They both affirmed that leveraging technology and fostering cross-sector collaboration is critical for closing compliance gaps, enhancing oversight, and ensuring that resolutions passed by the National Assembly are fully implemented for the benefit of all Nigerians.