FMDQ Total Income Slides 45% on Reduced FX Derivatives Trading

FMDQ

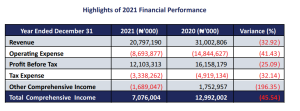

FMDQ Group Plc has reported a 45% slide in total comprehensive income for the 2021 financial year, largely as a result of reduction in fees it earned on FX derivatives trading, which affected overall revenues.

Total comprehensive income fell to N7.076 billion, from N12.99 billion in 2020. The total revenue earned by the Group in 2021 was N20.80 billion, a 33% decrease from N31 billion earned in 2020.

“Reduced participation in the currency derivatives product and the resultant decline in the revenue earned from Post-Trade Services rendered by the Group’s Clearing & Central Counterparty (CCP) subsidiary, FMDQ Clear, was the primary driver of this decline,” the firm said in its annual financial statement.

In 2021, the total revenue earned by FMDQ Clear was N15.58 billion, a 38% decline from N25.09 billion recorded in 2020. Clearing and Futures Management Fees earned from the trade matching and overall administration of executed derivatives contracts declined by 52% to N8.27 billion.

Similarly, Futures Investment Services Fees earned from the margin and investment management services declined by 19% to N5.69 billion, contributing 37% to the total revenue for the year.

FMDQ also got hit by a 7% decline in the total market activity in the Fixed Income, Currencies and Derivatives markets, to N198 trillion in 2021 from N215 trillion in 2020.

“Despite the economic headwinds experienced in 2021, FMDQ made significant strides in building its businesses across the value chain of the financial market, with a focus on innovation, operational efficiency, and product/market development,” FMDQ CEO Bola Onadele. Koko, said.

FMDQ is a financial markets infrastructure group.