Analysts project 2% growth for Nigeria’s economy in 2021

Analysts at the United Capital has projected 1.7 per cent to two per cent Gross Domestic Product (GDP) this year for Nigeria economy.

They expressed that growth is buoyed by increased economic activity and some improvements in the global oil market.

They also projected the headline inflation rate to peak at around 16per cent if there is no further policy adjustment.

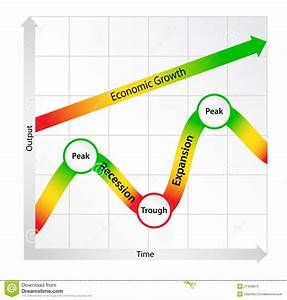

United capital in its Nigeria Outlook for 2021: “A short recovery” report on Monday said, “In 2021, we expect GDP growth to rebound by 1.7 per cent to two per cent, buoyed by increased economic activity and some improvements in the oil market.

“Although the reopening of the borders in Q4-2020 should ease pressures on food prices, other structural factors such as FX market illiquidity, potential increases in petrol price, etc. may keep general prices elevated.

“As a result, we expect the headline inflation rate to peak at around 16 per cent before pulling back, if no further policy adjustment is made.

“Again, the high base effect of the headline inflation spike in Q3 and Q4 2020 should moderate further increases in price levels.

“In response to rising inflation and in a bid to attract FPI inflows to the market, we imagine that the CBN would begin to tighten its monetary policy stance at some point in Q2-Q3 2021.

“Finally, on the exchange rate, we expect a potential convergence of rates when the CBN begins full intervention at the I&E window.

“As such, we anticipate that the parallel market will appreciate from N470/$ towards the NAFEX rate which has now been adjusted to N410/$.”

According to the report, they explained that Covid-19 took its toll on the Nigerian economy in 2020, after the federal government-imposed widespread nationwide lockdowns in Q2-2020 to contain the virus.

They explained that the oil market collapse wiped out export earnings and 50 per cent of government revenue, even as domestic economic activities were ground to a halt in the country’s largest commercial hubs.

Part of what happened, according to them was that the Central Bank of Nigeria (CBN) devalued the Naira on its official and I&E windows in the face of the pandemic, launched a series of intervention programs slashed the monetary policy rate and kept the system inundated with liquidity.

Others are “Similarly, amid pressure on both oil and non-oil revenue, the FGN was forced to take bold actions. The pump price of petrol was somewhat deregulated, electricity tariffs were hiked, and the closure of the land borders was reviewed.

“Despite the concerted efforts, the economy slipped into another recession as GDP contracted in Q2 and Q3-2020. Inflation galloped to a 33-month high of 14.89% y/y in Nov -2020, amid sharp food price increases and the currency market crisis.

“Also, the CBN imposed administrative measures to curb the depletion of the external reserves, which slid to $35.4bn (down $3.2bn YTD) in Dec-2020. As such, the parallel market rate crossed N500/$ in Q4-2020 while foreign capital inflows hit rock bottom.”

The report stated that Nigerian financial markets continued dancing to the tune of monetary policy actions in 2020.

They explained that the CBN through its heterodox policy actions, following restrictions on OMO bills in late 2019, arguably remained the conductor of the orchestra, setting the tempo for capital flows. Matured bills issued in 2019 flooded the financial markets, overloading the system with liquidity in 2020.

According to the report, “In 2021, sentiment for stocks depends on the direction of monetary policy, particularly concerning the yield environment.

“A sharp reversal of rates is likely to trigger a sell-off in the equities market considering that the current average market price-to-earnings (P/E) valuation multiple (15.2x) is considerably higher than the 5-year historical average (11.9x).

“While we predict that the rate reversal, which appeared to have been triggered in Dec2020, will become more apparent from Q2-2020, the yield environment may not reverse to double digits until late 2021 or later.