Nigeria’s 2021 Debt Stock Climbed as New Eurobond Issue Settled at 8.375% Coupon

Nigeria will become the first African country to access the international capital market in 2022. Through the Debt Management Office (DMO), the Federal Government announced the government raises US$1.25bn 7-year Eurobond. The issue had a coupon of 8.75% per annum, but investor interest reduced the rate to 8.375%.

The subscription remained high at US$3.68bn, indicating an oversubscription of +198.08%. According to the DMO, the Offer attracted investors from the United States, Europe, and Asia; Nigerian investors also participated in the Offer with a total subscription of US$60m.

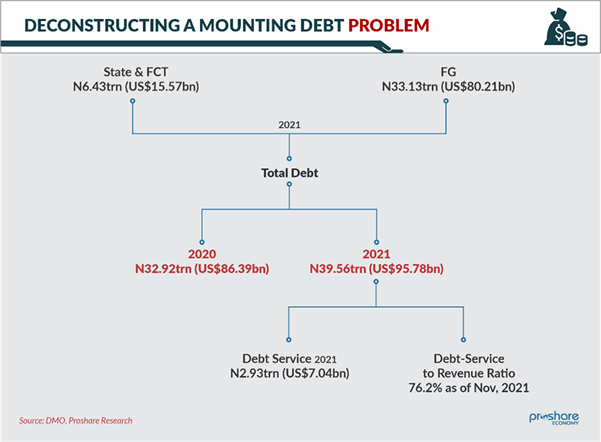

This announcement comes after data for the total debt stock for 2021 was released by the DMO. Total debt rose Y-on-Y by +20.17% to N39.56trn (US$95.78bn) from N32.92trn (US$86.39bn) stock. Debt-service to revenue was 76.2% as of November 2021, although the DMO seems to play it safe by using the debt-to GDP ratio, which currently stands at 22% as of 2021.

The Director-General of DMO, Mrs. Patience Oniha, tried to make a case for the government, stating that Nigeria was prudent in managing its debt-to-GDP ratio at 22% as the country’s Medium Term Expenditure Framework (MTEF) sets this ratio at 40%. The World Bank and ECOWAS set a 55% and 70% benchmark for countries like Nigeria.

However, Analysts do not see the debt-GDP ratio as a good metric to measure the sustainability of the debt size of the economy. The cost of the debt related to revenue generated should be the crux (see chart 1 below).

Adopting the Telecommunications template in granting operating licenses in specific sectors, such as the power sector and the oil and gas sector in terms of refineries, should be a revenue-generating alternative for the government. Debt isn’t necessarily a negative thing; nevertheless, the projects financed with it should be able to generate enough money to service the debt and pay it off. That is not the case in Nigeria, where debt goes into recurrent expenditure rather than revenue-generating capital projects.

The debt-service-to-revenue ratio worsens with more expensive borrowings, such as the Eurobond markets and larger debt stock. Because a considerable amount of the revenue earned is needed to service debts, this has a significant negative impact on the government’s spending ability.

Also, because the government is the largest spender, any reduction in government expenditure will hurt aggregate output and slow economic growth. If done in the domestic market, continued expenditure/spending, notwithstanding the magnitude of the revenue, will result in greater borrowing, resulting in a crowding-out effect. Credit ratings are factored into the pricing in the international market, resulting in increased borrowing costs, as is the situation with Nigeria.