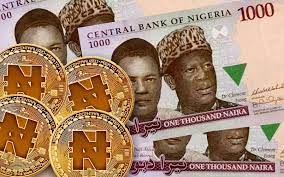

E-Naira Transactions Volume Hits N5bn

The Central Bank of Nigeria (CBN) has revealed that the circulation of the e-naira has risen to N401.82 million as transaction volume rises from over N4 billion to N5 billion.

This was disclosed by Hajiya Rakiya Mohammed, Director of Information and Technology at the CBN on Monday, during the 2nd Edition of the Africa Cashless Payment Conference.

She noted that the CBN prides the e-naira on being pair-to-pair, hence, no charges for now. She also disclosed that the financial system is big enough to accommodate everyone.

“E-naira is easy to onboard, get it, fund it, use it, anyone can be on board with it. In Nigeria, we have had several drivers for IT growth; inclusive payment is a rallying driver for the CBN,” she said.

She noted that today Nigerians can make instant payments, which has gone through quite a number of transformations, including mobile money instant payments.

She said these have helped to drive digital transformation, citing that the e-naira is the same naira we have but in electronic form, is legal tender in Nigeria, and carries the same exact value as the current naira.

“It is a replica. Basically, they are exactly the same, the digital equivalent of current cash and parity exchange 1:1 with cash,” she said.

She revealed that its objectives were financial inclusion and Nigeria was the first to launch a central bank digital currency with an operational CBDC, citing that currently, 401.82 million is in circulation, with the volume of transactions over N3.5 billion.

“Both banked and unbanked can use it and can be done through USSD *997#. We have integrated it with telecoms and NIBBS instant payments plus integration with money transfer operations so that you can use e-naira for cross border.”

On opportunities for e-naira, the CBN pointed out a reduction in the cost of cash, an increase in revenue, and direct disbursement to citizens as the e-naira is programmable so that it can only be used for the reason money is distributed for specific events and integrating with the Pan African Exchange system (PAPPS).

The CBN said it prides itself in being pair-to-pair. That’s why no charges for now and that gives benefits to the economy, including reducing the cost of cash management, as Nigerians spend 100s of millions to manage cash payments and enable eco-friendly usage.