Cornerstone Insurance Profit Surges 1,644% on N11.91bn FX Gains

Cornerstone Insurance Plc profit has surged in the third quarter, thanks to foreign currency revaluation gains as the insurer continues to magnify revenues through the introduction of innovative products.

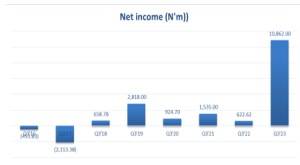

The underwriting firm saw net income surge by 1,644 percent to N10.86 billion in September 2023 from N622.11 million as at September 2022. ‘

Drilling down the numbers shows the Cornerstone Insurance Profit growth was largely driven by a N11.91 billion foreign exchange revaluation gain as a currency devaluation lifted the dollar denominated assets in the balance sheet.

Of course, the exceptional gains made up for the deteriorating underwriting performance. The company is grappling with claims inflation as the replacement costs of assets have gone up, while a tough operating environment means the insurer is paying more in management expenses in generating premium income.

Combined ratio deteriorated to 177.18 percent in September 2o23 from 114.41 percent the previous year. And that resulted in negative real underwriting returns of N19.12 billion, according to calculations.

The combined ratio is a measure of profitability used by an insurance company to gauge how well it is performing in its daily operations. A ratio below 100 percent indicates that the company is making an underwriting profit, while a ratio above 100 percent means that it is paying out more money in claims that it is receiving from premiums.

Claims ratio rose to 69.10 percent in the period under review from 32 percent as at September 2022.

Cornerstone Insurance paid N4.87 billion in claims to policyholders in the first nine months, which is a 106.35 increase from 2022’s N2.36 billion.

Total expense ratio increased to 108.73 billion in the period under review from 82.42 percent as at September 2022.

Cornerstone Insurance’s gross premium income (GPI) was up 24.74 percent to N19.85 billion from N15.88 billion as at September 2022.

A breakdown of gross premium income figure shows revenue from the Non-Life segment stood at N15.19 billion as at September 2023, which is 54.21 percent higher than 2022’s N9.85 billion.

Premium from Life business was up 4.05 percent to N4.25 billion in the period under review from N4.05 billion the previous year.